Payroll penalty calculator

Heres the information youll need for your calculations. The tax is thus withheld or deducted from the income due to the recipient.

What Are The Required Payroll Deductions In Ontario Filing Taxes

The provided calculations do not constitute financial tax or legal advice.

. People who are uninsured do not face a penalty unless theyre in a state that has its own individual mandate and a. Depending on the size of your payroll you must make deposits monthly or semi-weekly. QuickBooks Online Payroll Elite Features.

The penalty for failing to file is 5 of the amount you owe per month or partial month which combines a 45 late filing fee with the 05 late payment fee. Then enter the employees gross. Online Payroll Reporting System.

You must also file a quarterly report on Form 941 showing the amounts you owe and how much you have paid. In most jurisdictions tax withholding applies to employment income. Payroll companies profit margins are high - thats why theyre able to offer you 3 to 6 months of services free or waive fees.

Failure to file your 940 or 941 payment on time will subject you to a late payment penalty. 5 The IRS assesses most of these penalties automatically. To avoid the IRS underpayment penalty you can choose between the following approaches.

Because the IRS relies on each business to report its 940 payments 941 payments it enforces very strict rules and steep fines to make sure that everyone complies by faithfully making their payments and filing their returns on time. The following tax returns wage reports and payroll tax deposit coupons are no longer available in paper. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

At Precise Payroll we are focused on a. Employers who chose to defer deposits of their share of Social Security tax were required to pay 50 of the eligible deferred amount by December 31 2021 and the remaining amount by December 31 2022. 2021 Tax Rates and breakdown of changes for Oregon employers.

Quarterly Contribution Return and Report of Wages Continuation DE 9C Employer of Household Workers Annual Payroll Tax Return DE 3HW. There is no federal government penalty for being uninsured in 2023 but you still need coverage. Recommends that taxpayers consult with a tax.

Recommends that taxpayers consult with a tax professional. 2022 than you did in 2021 or end up. 2021 UI Tax Relief fact sheet.

The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. In 2020 an executive memo was released allowing employers to defer payroll taxes for employees. Learn more about tax penalty protection.

Youll need to gather information from payroll to calculate employee withholding tax. Payroll for QuickBooks Desktop. If you expect to earn about the same amount as last year you can take the amount of tax you paid on your 2021 return and divide it by four to figure out your 2022 quarterly estimated tax amount.

The minimum penalty is 100 and increases by 25 per day. Find my W-2 online. Payroll Payroll services and support to keep you compliant.

Additionally IRS Notice 2020-65 allows employers to defer. Quarterly Contribution Return and Report of Wages DE 9. If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty up to 25000.

General Oregon payroll tax rate information. Payroll period details including the frequency of your pay periods weekly biweekly or monthly and the amount of time for that particular period. OSPs role is to ensure fairness and consistency in FTD penalty assessment.

COVID-19 Interest and Penalty Relief Application. An employer is required to withhold federal income and payroll taxes from its employees wages and pay them to the IRS. This deposit penalty calculator can be used for forms 941 944 940 945 720 with limits 1042 and form CT-1 to provide deposit penalty and interest calculations.

This CRA interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of CRA interest on tax debt. The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. Sample Penalty Relief Letter.

Contact the UI Tax Division. 941 Penalty Calculator 941 Late Payment Penalty. Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis.

The provided calculations do not constitute financial tax or legal advice. If you use this method but end up earning more money in. If you receive a tax notice and send it to us within 15-days of the tax notice we will cover the payroll tax penalty up to 25000.

Only QuickBooks Online Payroll Elite users are eligible to receive the tax penalty protection. The ACAs federal individual mandate penalty has been 0 since the start of 2019 and that will continue to be the case for 2023. File your tax return on time Pay any tax you owe on time and in the right way Prepare an accurate return Provide accurate information returns We may charge interest on a penalty if you dont pay it in full.

Now the late filing fee also maxes. The IRS charges a penalty for various reasons including if you dont. Additional conditions and restrictions apply.

Withheld payroll taxes are called trust fund taxes because the employer holds the employees money federal income taxes and the employee portion of Federal Insurance Contributions Act FICA taxes in trust until a federal tax deposit of that amount is made. The Business Support Office BSO is under Operations Support OSSBSE is responsible for overseeing civil penalties. Respond or if you respond incorrectly the IRS will charge you the tax it thinks you owe plus interest and possibly a penalty.

Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis. Payroll Deductions Online Calculator PDOC You can use this application to calculate payroll deductions for all provinces and territories except Quebec. 4 Individual business and payroll penalties for failure to file failure to pay and failure to deposit the types potentially eligible for FTA were 74 of all penalties assessed in 2012.

Additional conditions and restrictions apply. See more information about the Tax Penalty Protection here. The Office of Servicewide Penalties OSP is responsible for civil penalty policy including IRM 2014 Penalty Handbook Failure to Deposit Penalty.

Employer of Household Workers Quarterly Report of Wages and. In fiscal 2012 the IRS assessed 379 million penalties against taxpayers totaling 268 billion. Tax withholding also known as tax retention Pay-as-You-Go Pay-as-You-Earn or a Prélèvement à la source is income tax paid to the government by the payer of the income rather than by the recipient of the income.

First you should figure out if. We charge some penalties every month until you pay the full. If you have many employees or dont have the staff to handle payroll processing you might want to consider a payroll processing service to handle.

Stop getting ripped off by your payroll company. UI Trust Fund fact sheet. It calculates payroll deductions for the most common pay periods such as weekly or biweekly based on exact salary figures.

UI Trust Fund and Payroll Taxes FAQ.

Stock Market And Financial Analysis In Flat Style Stock Market Analysis Stock Market Png And Vector With Transparent Background For Free Download Financial Analysis Stock Market Stock Market Trends

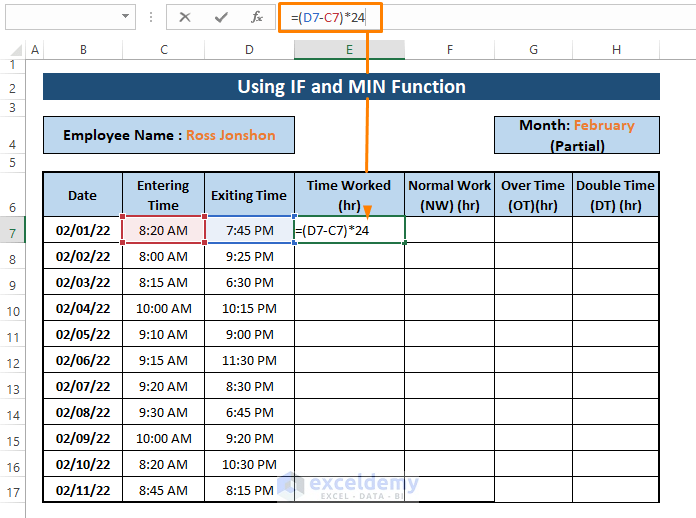

Excel Timesheet Calculator Template For 2022 Free Download

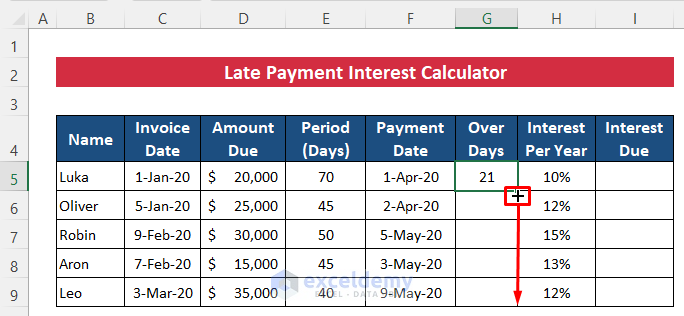

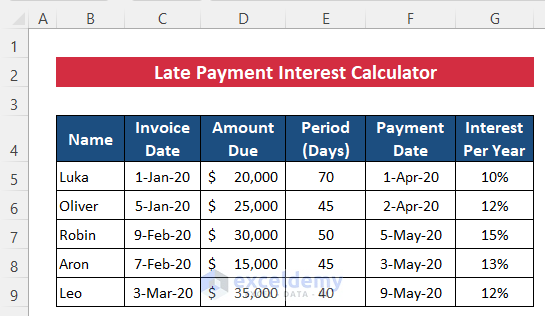

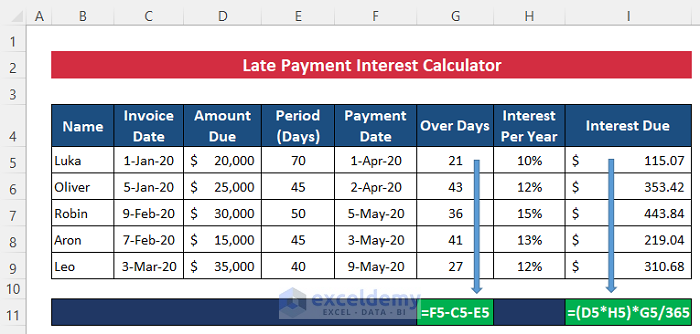

Calculate The Consequences Of Late Payments On Your Business

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

All Microsoft Excel Templates Free To Download Free For Commercial Use Excel Templates Interest Calculator Credit Card Interest

Calculate Bonus In Excel Using If Function Youtube

Unique Multiple Employee Timesheet Xls Xlsformat Xlstemplates Xlstemplate Check More At Timesheet Template Budget Spreadsheet Template Cover Letter Example

Create Late Payment Interest Calculator In Excel And Download For Free

Unique Multiple Employee Timesheet Xls Xlsformat Xlstemplates Xlstemplate Check More At Timesheet Template Budget Spreadsheet Template Cover Letter Example

Excel Timesheet Calculator Template For 2022 Free Download

Late Coming Format In Excel Excel Format Education

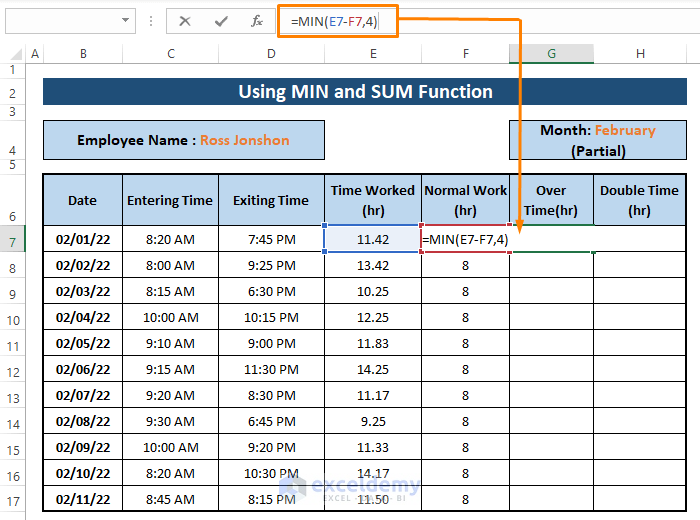

Excel Formula To Calculate Overtime And Double Time 3 Ways

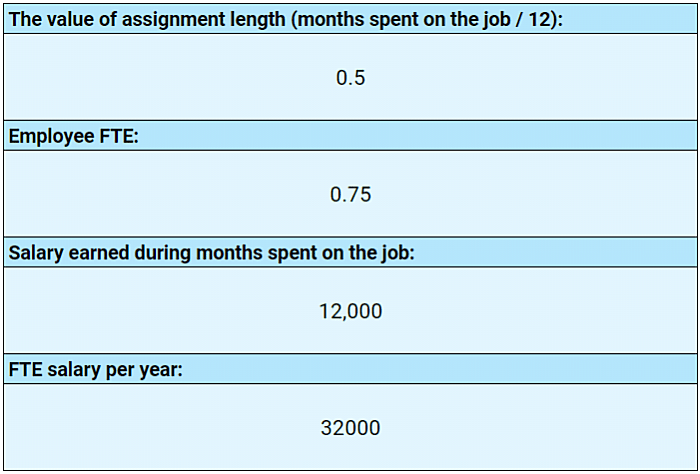

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

Create Late Payment Interest Calculator In Excel And Download For Free

Excel Formula To Calculate Overtime And Double Time 3 Ways

Create Late Payment Interest Calculator In Excel And Download For Free

Hourly Rate Calculator The Filmmaker S Production Bible